The minimum wage across the country is due to go up this April, however, the rise in living costs has created the fear that it will not be enough to live off.

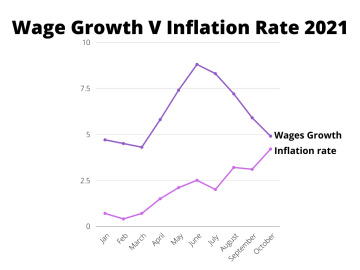

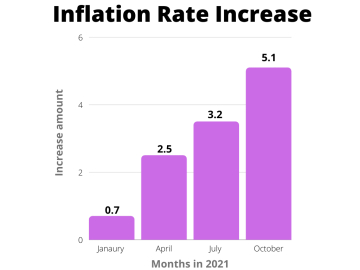

Inflation rates are now at the highest they have been in 10 years according to the Office for National Statistics.

The cost of living which includes energy bills, public transport, and TV/ Broadband licenses are due to go up even more in 2022.

Kelly Waller, a local sales assistant, explained: “My paycheck is currently 90% gone because I had to use it every month to pay rent, bills, tv, and everything else, and now that percentage is only going to get higher as prices go up, which is ridiculous.”

90% of my pay check is gone”

Although the lowest-paid living wage is due to rise by 6.6% to £9.50 this coming April, which is higher than the current inflation rate, it is still not comforting to some residents.

Kelly continues by saying: “Yes, that income may be going up but not by much. It’s going up by less than a pound whereas my energy bill could go up by hundreds of pounds.

“How do they expect me to live like that?”

Why is the rise in inflation happening?

The main factor contributing to the current rise is the wholesale cost of energy increases.

The cost to source, supply, and transport energy has gone up for the many UK and global energy providers leading to them putting extra fees onto customer contracts.

Also, supply costs for products and higher shipping fees are leading to many retail store owners having to hike up their product prices to still turn a profit.

What can be done to lower the rate of inflation?

Normally when inflation rates are on the rise, UK banks will respond by increasing interest rates on all loans, mortgages, and finance.

If they choose to do this, then UK citizens who have borrowed money for any kind of reason could see a rise in the monthly payback fees.

Nicky Linford, a local homeowner, explained: “As it stands my mortgage rate is reasonable however our income is not the best with my husband being off work with a leg injury.

“If rates were to rise I am scared that, on my income alone, we would definitely struggle.”

The rise in energy bills, TV bills, and transport are all due to be announced in the coming months with the government exploring ways on how to bring these costs down or help support those struggling from them.

Solar farm consultation taking place in Poole today

Solar farm consultation taking place in Poole today